Inside Harvard's Dominant $100B+ Health Tech Ecosystem

Startups such as Peloton, Fitbit, Whoop, and Strava have solidified Harvard's legacy in health tech

Phoenix is a pre/seed stage venture capital firm investing in Harvard- and HBS-founded startups. Subscribe below to stay up-to-date on the latest insights, research and happenings from the Harvard/HBS’ startup ecosystem.

Harvard’s startup ecosystem is a dominant force in healthcare innovation. In the last 10 years, 10+ Harvard-founded health tech startups have IPO’d, creating substantial economic value while driving profound societal contributions in the process.

Top 10 Harvard-founded, Health-related IPOs

$34B+ in economic value was created by these 10 health-impacting, Harvard-founded IPOs — remarkable, right!? Leading the pack are four companies you know well: Peloton, Oscar Health, Fitbit and 23&Me.

Peloton. Peloton is an interactive fitness platform reinventing fitness with live and on-demand boutique studio classes. Founded in 2012 by John Folly (HBS, 2001), Peloton went public in 2019 valued at $8.1B. Key investors include: a kickstarter campaign and Tiger Global Management.

Oscar Health. Oscar is a health insurance company that offers individual and family plans, Medicare advantages, and small group products. Founded in 2012 by Josh Kushner (College) and Mario Schlosser (HBS, 2007), Oscar went public in 2021 valued at $7.9B. Key investors include: Founders Fund, Khosla Ventures, General Catalyst, Thrive Capital, SV Angel, and Red Swan Ventures.

Amwell. Amwell is a telehealth platform that provides its patients with more affordable, higher quality health care. Founded in 2006 by Roy Schoenberg (College), Amwell went public in 2020 valued at $4.1B. Key investors include: SV Health Investors, Northwell Holdings & Ventures, and the Thomas Spiegel Family Foundation.

Fitbit. Fitbit offers compact, wireless, wearable sensors that track a person’s daily activities in order to promote a healthy lifestyle. Founded in 2007 by James Park (College, 1998), Fitbit went public in 2015 valued at $4.1B. Key investors include: Y Combinator, Uncork Capital, True Ventures, and Foundry.

23&Me. 23andMe is a DNA testing technology company that enables its users to access their ancestry, genealogy, and inherited traits. Founded in 2006 by Paul Cusenza (HBS), 23&Me went public in 2021 valued at $3.5B. Key investors include: NEA and Google Ventures.

Let’s chat! Share a note: devon@phoenixclub.vc

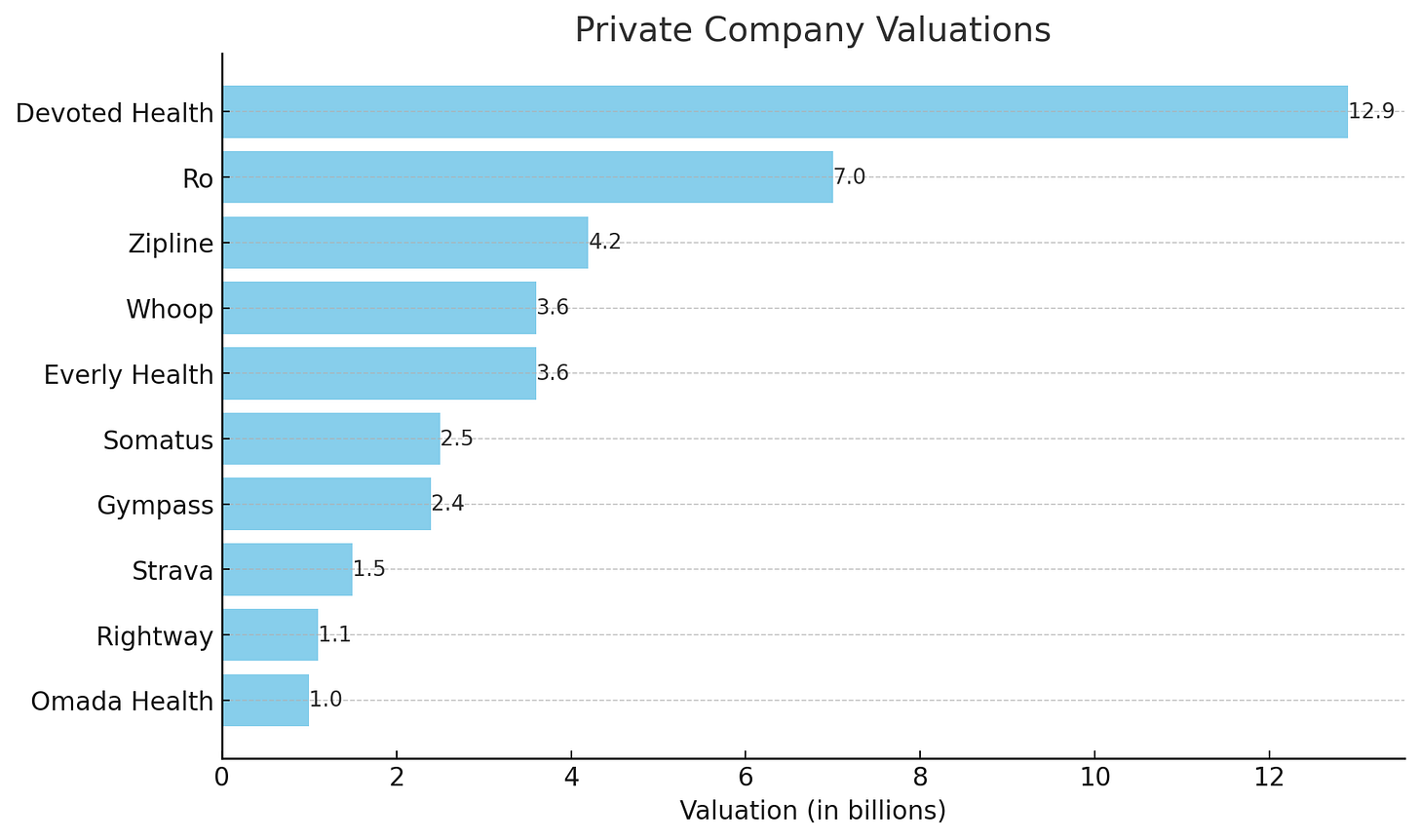

Harvard’s leadership in Health Tech extends well into private markets too

Ro. Ro is a telehealth startup that operates digital health clinics for men’s and women’s health, along with smoking cessation. Founded in 2017 by Rachel Blank (HBS, 2018), Ro is currently valued at $7B, having raised $1B+ in funding from key investors including: General Catalyst, Initialized Capital, Slow Ventures, Firstmark Capital, and many more.

Zipline. Zipline designs, manufactures, and operates drones to deliver vital medical products. Founded in 2011 by Keller Rinaudo Cliffton (College, 2009), Zipline is currently valued at $4.2B, having raised $800K+ in funding from key investors including: a kickstarter campaign, Techstars, Slow Ventures, Sequoia Capital, and SV Angel.

Whoop. Whoop is a performance optimization system that tracks athlete recovery, training, and sleeping hours to help boost performance. Founded in 2012 by Will Ahmed (College, 2012), Whoop is currently valued at $3.6B, having raised from key investors including: Nextview Ventures, Founder Collective, and Atlas Venture. Whoop story here.

Gympass. Gympass provides employees with flexible access to gyms, studios, classes, training, and wellness apps. Founded in 2012 by Cesar Carvalho (HBS, 2013), Gympass is currently valued at $2.4B, having raised $600K+ in funding from key investors including: Koolen & Partners, Provence Capital, Headline, and Redpoint Ventures.

Strava. Strava is an online network where runners and cyclists can record their activities, compare performance, and compete with their community. Founded in 2009 by Michael Horvath (College, 1988), Strava is currently valued at $1.5B, having raised $150M+ from key investors including: Sigma Partners and Madrone Capital Partners.

And the future is bright…

Early stage Harvard founded healthcare companies:

Curebase, powering clinical trials with better technology

Allara, online PCOS and Women’s hormonal healthcare

Trove Health, making decentralized clinical trials simple

Thermaband, creating a wellness device for menopause

Helio Sleep, making sleep apnea treatment easy

Anise Health, a digital mental healthcare platform for the BIPOC community

Serif Health, price transparency & analytics software for healthcare providers

Vena Vitals, continuous blood pressure monitoring through smart wearable

Orchid, the most efficient EHR for independent mental health professionals

and many many more!

About Phoenix Fund

We invest in a diversified portfolio of early-stage Harvard startups, harnessing the power of the Harvard ecosystem to provide outsized value through collaboration

We host events, treks, and happy hours to build community among Harvard founders, funders, students, & alumni (subscribe to stay up-to-date)

We research Harvard’s startup and venture ecosystem, bringing the latest updates, insights, and stories directly to your inbox

Cheers,

The Phoenix Team

Let’s chat! Please share a note: devon@phoenixclub.vc