Harvard's 28 IPOs Worth $279B, Last 5 Years

A deep dive into the data underpinning the success of Harvard's startup ecosystem over the last five years (2019-2023)

Phoenix Fund is a pre/seed venture capital firm investing in Harvard-founded startups. Follow Phoenix on LinkedIn & Twitter. At Phoenix Fund Research, we strive to be a cornerstone for quantifying Harvard’s historic startup success and a catalyst for continued innovation.

Overview:

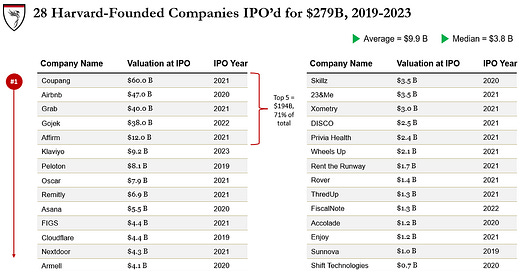

28 Harvard-founded companies IPO’d over the last five years (2019–2023) with a staggering aggregate IPO valuation of $279B

The average Harvard-founded IPO valuation ($9.9B) was nearly $7B greater than the average non-Harvard founded IPO valuation, during the same time frame

Harvard is a leader in both outlier production rate and expected value of outcomes, with alumni producing many companies we all adore

Harvard is one of the most successful startup ecosystems in the world. Its students and alumni have founded many of our world’s most transformative companies, not only shaping the global economy but also propelling society forward.

→ 86, the number of HBS-founded Unicorns, more than any other MBA program

→ 164, the total number of Unicorns founded by the Harvard system

Harvard’s entrepreneurial success has endured generations, and the last five years have been no different. From 2019 to 2023, 28 Harvard-founded companies IPO’d for an aggregate valuation of $279B.

Breakdown by Year

2020 and 2021 proved to be the most exciting years for Harvard’s startup and venture ecosystem. In 2020, 6 companies went public with an aggregate $62B value, representing ~9% of the total value of all IPOs. In 2021, 16 companies went public with an aggregate $154.6B value, representing a whopping ~13% of the total value of all IPOs.

A Leader in Outlier Production & Expected Values

Outlier Production: The volume of Harvard-founded IPOs underscores the school’s status as a leader in outlier production (defined here by the rate at which $1B+ outcomes are produced). In our case, Harvard produced 28 IPOs across a 5-year span (2019–2023).

Expected Values: The top five IPOs boasted an aggregate $194B in IPO valuation, representing 71% of all value generated by Harvard-founded startups from 2019–2023. 36% of Harvard-founded IPOs were valued greater $5B, with four companies valued over $35B. The average and median data is impressive too, far exceeding peers in their IPO cohort:

→ Average Harvard-founded IPO Value: $9,949,285,714

→ Median Harvard-founded IPO Value: $3,800,000,000

According to research from The University of Florida, the average IPO during the same timeframe (2019–2023) was $2.92B, nearly $7B less than the average Harvard-founded IPO.

Breakdown by School

20 of the 28 Harvard IPOs (71%) were founded by Harvard Business School founders. Harvard College, Harvard Law School, and Harvard’s School of Public Health were also represented, though modestly in comparison to HBS.

Select IPOs

Airbnb: Founded by Nathan Blecharczyk (Harvard College, 2005) in 2008, Airbnb has revolutionized overnight stays across the world. The company IPO’d in 2020 at a $47B valuation.

Coupang: Founded by Bom Kim (Harvard College & HBS) Christopher Koh (HBS) in 2010, Coupang is “the Amazon of Asia.” The company IPO’d in 2021 at a $60B valuation.

Klaviyo: Founded by Andrew Bialecki (Harvard College, 2007) in 2012, Klaviyo is one of the only three tech IPOs so far in 2023. Klaviyo is a SMS and email marketing tool. The company IPO’d in 2023 at a $9.2B valuation.

Peloton: Founded by John Foley (HBS, 2001) in 2012, Peloton is a leading internet-connected stationary bike bringing fitness classes to homes across the world. The company IPO’d in 2019 at a $8.1B valuation.

Wheels Up: Founded by Bill Allard (HBS, 1989) in 2013, Wheels Up is a membership-based private jet company. The company IPO’d at a $2.1B valuation.

Rent The Runway: Founded by Jennifer Hyman (Harvard College & HBS) and Jennifer Fleiss (HBS, 2009) in 2009. Rent the Runway is an online e-commerce website that allows women to rent designer apparel and accessories. The company IPO’d at a $1.7B valuation.

Additional Key Observations

Power Law Persists. While 28 Harvard-founded companies went public from 2019–2023, the top 5 represent 71% of Harvard’s total value. Not far off from the 80/20 rule, it is clear that a small number of outcomes drive the vast majority of value.

Harvard’s impact is very much global. 3 of the top 5 IPOs were from companies based outside of the US: Coupang, Grab, and Gojek. Furthurmore, many Harvard-founded companies — Airbnb & Peloton, for example — have reached great global scale, contributing profoundly to the world economy.

Harvard founders prevail in times of crisis. Airbnb, Zynga, Asana, ThredUp, Rent the Runway, and Cloudflare were all among then many successful ventures founded by Harvard alumni in 2008 or 2009, amidst the financial crisis.

Methodology / Criteria

Company has at least one co-founder who attended a Harvard school

Bioscience & lifescience startups excluded

Company IPO’d between January 1, 2019 and Novemember 20, 2023

In Closing

Thanks for taking the time to read. At Phoenix Fund Research, we post weekly data and insights from the Harvard startup and venture ecosystem. If you enjoyed, be sure to subscribe. If any comments or questions, please feel free to email devon@phoenixclub.vc.

Cheers,

The Phoenix Team

The views expressed herein are solely the views of the author(s) and are not necessarily the views of Phoenix Investment Club I LLC or any of its affiliates. They are not intended to provide, and should not be relied upon for, investment advice.